Understanding Company Structures and Workflow

Firms are complicated entities that play a critical duty in the worldwide economy, influencing every little thing from regional markets to worldwide trade and work patterns. At its core, a corporation is a legal entity that is separate and unique from its proprietors, giving them with minimal liability defense. This structure allows corporations to elevate funding with the sale of shares, which represent a stake in the firm's possession and can be traded on various supply exchanges around the world. Business administration, the system through which firms are routed and controlled, entails a board of directors and management groups that make strategic decisions to drive the firm onward. The investors, although owners, do not straight handle the day-to-day operations however need to accept major decisions and elect the board of directors.

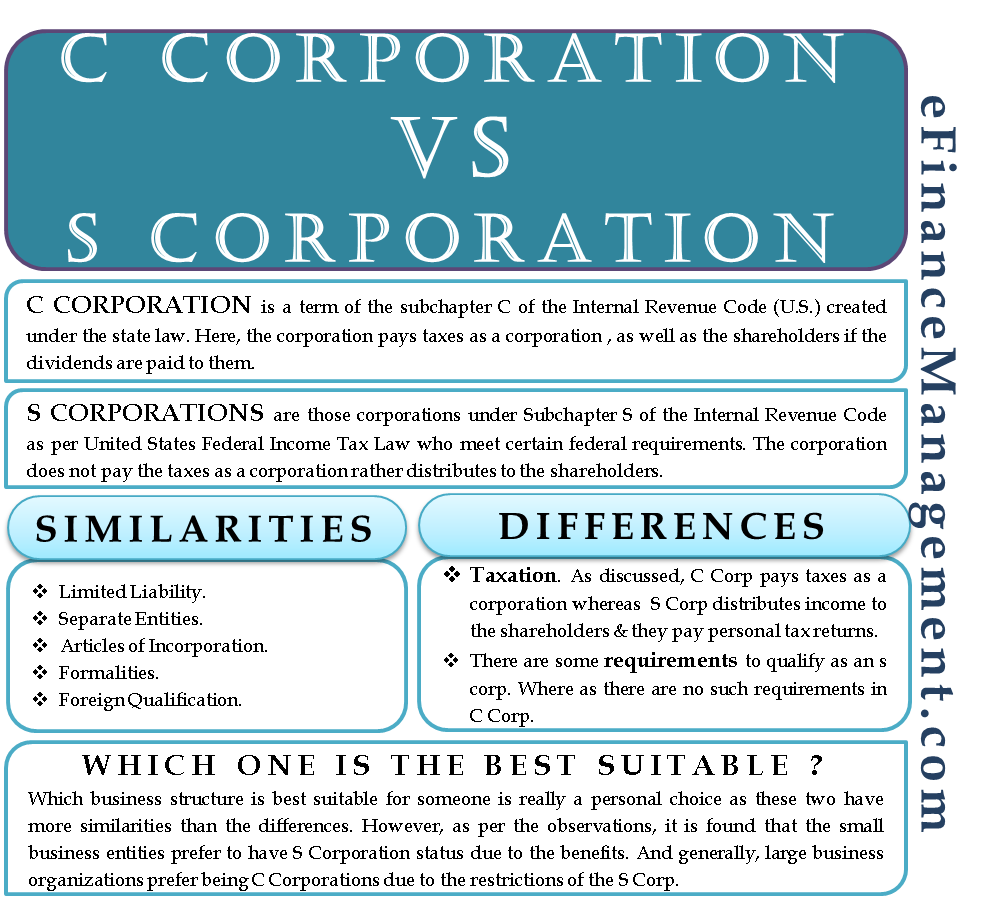

Corporations can be categorized into several kinds based on different standards such as structure, possession, and jurisdiction. Openly traded business, for instance, have shares that are provided on public stock market and can be bought by any investor. In contrast, personal firms are possessed by a non-governmental organization or a fairly small number of investors, and do not market shares to the public. One more important distinction is in between for-profit corporations, which intend to make the most of shareholder value, and charitable firms, which intend to meet a charitable mission without returning revenues to their members. Furthermore, the territory under which a company is established can impact its service techniques and lawful requirements. A company in the United States may have different regulative restraints compared to one established in the European Union, impacting everything from tax commitments to reporting criteria.

Review of Company Structures and Features

Companies are intricate entities that are indispensable to the worldwide economy, identified by their one-of-a-kind legal identification, distinctive from those of their owners. This splitting up pays for the corporation's investors limited obligation for the company's financial debts and activities, an important function that has moved the proliferation of these entities worldwide. Commonly, corporations are structured to make the most of functional performance and shareholder worth. This structure usually includes a board of directors in charge of broad tactical oversight and a management team that deals with the daily operations. The communications in between these functions are essential to company governance and are led by a framework of exterior laws and inner policies. Moreover, corporations can be classified by numerous criteria, such as the range of procedures (varying from small independent services to big multinationals), the source of financial investment (public or private), and market field (modern technology, finance, etc), each bringing different calculated concerns and challenges. The evolution of corporate methods has been noticeably influenced by technical innovations, globalization, and altering social expectations, which have pushed firms to not only focus on success but also on sustainability and business obligation. These shifts indicate a dynamic landscape where firms are continually adjusting to new market conditions, regulatory atmospheres, and public beliefs.

Secret Corporate Frameworks and Administration Models

Recognizing the complexities of company frameworks and administration models is important for realizing how services run and are regulated. A common company may be structured under different designs, each specifying the functions and duties within the organization to simplify operations and enhance accountability. One of the most common framework is the hierarchical design, where the hierarchy starts with the board of supervisors on top, adhered to by the CEO and top management, and afterwards front-line workers and center supervisors. This structure is important as it marks clear lines of authority and decision-making paths, which are necessary for large organizations requiring extensive order and methodical functional treatments. Nevertheless, contemporary firms are significantly being attracted towards more flexible designs, such as matrix or level structures, which permit for greater agility and faster decision-making by decreasing layers of administration. These designs motivate a more joint environment where technology can prosper, particularly in sectors where fast action to technical advancements and market modifications is vital. Governance within these structures is additionally adjusting, with many companies currently emphasizing wider stakeholder interaction, honest methods, and sustainability. This shift reflects an expanding recognition of company obligations prolonging beyond investor revenues to include ecological and social effects, consequently reshaping traditional administration techniques to be more comprehensive and forward-thinking. The development of business frameworks and governance designs not just shows the changing landscapes of sectors but likewise indicates a much deeper understanding of the characteristics between corporate control, worker involvement, and long-lasting company sustainability.

Understanding Company Structures and Governance

Companies, identified as intricate entities in business globe, operate via meticulously arranged frameworks that specify their interior pecking order and governance. At the core of a corporation's structure is the board of supervisors, charged with overarching obligations for organizational oversight, strategic instructions, and making sure business accountability. Board participants, normally elected by investors, hold the authority to make pivotal decisions that can shape the company's future, from authorizing financial spending plans to setting long-term goals. This framework is vital not only for day-to-day management however likewise for straightening the interests of numerous stakeholders involved, including staff members, consumers, and investors. In addition, the exec monitoring group, led by the CEO, manages the implementation of these methods, steering the corporation in the direction of its objectives while adhering to the board's directives. This twin structure guarantees a balance of power, with the board giving checks and equilibriums on the executives, hence alleviating the threats linked with centralized control. Additionally, business governance includes various methods and policies that include another layer of liability, such as routine bookkeeping procedures, clear reporting devices, and ethical company techniques. These administration practices are crucial for preserving financier count on and can dramatically affect the firm's online reputation and, eventually, its success in an open market setting. Understanding these components is essential for any individual engaged with or interested in the business industry, as they create the backbone of exactly how contemporary firms are run and exactly how they navigate the intricacies of today's financial landscape.

Strategic Initiatives and Future Outlook of Modern Firms

In the fast-evolving business world, tactical initiatives and planning are pivotal for business intending to preserve competitive advantage and make sure sustainable growth. Companies today are increasingly concentrating on development, electronic change, and sustainability as core parts of their critical agendas. Technology, specifically, is driving businesses to reconsider their product and solutions, motivating a change from conventional methods to much more sophisticated, technology-driven solutions. This is not only boosting performance yet also opening brand-new markets and opportunities. The fostering of fabricated intelligence and machine learning is changing fields from financing to manufacturing, allowing business to predict market patterns and consumer needs with unprecedented precision.

As the international emphasis on ecological sustainability intensifies, firms are compelled to incorporate eco-friendly practices right into their procedures. This change is not simply concerning conformity with regulatory requirements however is likewise coming to be a considerable consider brand track record and customer commitment. Firms are buying eco-friendly power, waste decrease techniques, and sustainable supply chains to satisfy both consumer assumptions and regulative criteria. These environmentally mindful techniques are likewise confirming economically advantageous as they frequently result in set you back savings in energy intake and waste management.

Digital makeover is one more important location where companies are investing heavily. The COVID-19 pandemic accelerated the need for electronic procedures and remote functioning capacities, pushing companies to update their IT framework and cybersecurity procedures. This digital change is helping with smoother operations and allowing firms to reach a bigger target market worldwide. It likewise fosters better data monitoring and analysis capacities, which are important for tactical decision-making and functional renovations.

Seeking to the future, firms are not just adapting to the transforming technological landscape yet are likewise preparing to encounter obstacles associated with international financial unpredictabilities, geopolitical tensions, and supply chain disturbances. Forward-thinking companies are therefore developing more durable threat monitoring structures and diversifying their operations to minimize possible influences. In addition, there is an expanding trend in the direction of more comprehensive and diverse corporate societies, as study continues to link diversity with raised creative thinking, better decision-making, and improved economic performance.

The landscape of modern corporations is dynamic and requires continuous adaptation and insight. killer deal of tomorrow are those that acknowledge the importance of these calculated campaigns today and are dexterous enough to develop with the altering worldwide service atmosphere. As corporations navigate with these intricacies, their ability to innovate, welcome sustainability, and change electronically will play a vital duty in shaping their future success and resilience in the marketplace.